Visit a nearby SARS office or call them on 0800 00 7277 and have your ID number with you. In this process bankers can get the genuine ITR on his own computer.

Know How To Login Into Income Tax Portal Income Tax Online Taxes Income

Nonresident alien who is required to file a US.

. Your employer and your tax advisor know your tax ID. Know your IT refund status using the Income Tax Refund status tool. Your TIN is most likely the business entitys Employer Identification Number EIN.

The TIN NSDL Portal. As an individual without a SSN. Maximise your refund Tim uses your answers to complete your income tax return instantly and professionally with everything filled in in the right place.

Using the IRS Wheres My Refund tool. Get to the Joint Tax Boards verification portal for step 1. If all else fails the business can contact the IRS on its Business and Tax Specialty line at 800-829-4933 Monday through Friday 7 am.

The good news is that SARS wont provide your tax number to another person so you can request it telephonically by calling the SARS Contact Centre on 0800 00 72 77. Visit the SARS website. It takes up to 4 weeks 1.

Let Tim submit your tax return direct to SARS in just a few clicks. Find Your Adjusted Gross Income AGI If youre changing your tax withholding youll need to know your adjusted gross income AGI. You dont need an appointment.

Salary IRP5 4693 posts. The specifics of your TIN as an entity should be reviewed with a legal advisor. How to Check Income Tax Refund Status through E-Filing Website.

See How Long It Could Take Your 2021 State Tax Refund. Make sure that you have your ID number on hand. Tell HMRC about changes that could affect your tax code.

Fill this form and the Finanzamt will send you a letter with your tax ID. You have a requirement to furnish a federal tax identification number or file a federal tax return and. Ask your employer.

The best option of verification of ITR- V is to ask the taxpayer to login income tax e-filing website incometaxindiaefilinggovin and download the ITR-V in front of bankers to check its genuineness. You can find your AGI number on your prior years tax return. However an entity with the legal structure of an S-corp corporations for example may have the TIN may be that of the owner.

What to do after registration. Use the service to. If you lost your tax ID there are 2 ways to find it.

If you need to find a companys EIN and you have done business with them that number may appear on any invoices youve received or other. You will receive your Income Tax Reference Number within 3 working days after completing an online application. Click on Submit to check the status of your refund.

If your tax number is not on those documents or if you are self-employed you can also phone SARS on 0800 00 7277 to check or you can request it online by following these steps. You are in one of the following categories. The following additional tax related services are offered to taxpayers via their mobile device.

This service covers the current tax year 6 April 2022 to 5 April 2023. When can you get your Income Tax Reference Number. On the top menu bar click on Contact Us.

Do so in early 2022 before filing your federal tax return to ensure the right amount is being withheld. Whether you owe taxes or youre expecting a refund you can find out your tax returns status by. Check your tax code and Personal Allowance.

They will tell you your tax ID 1 2. Request an eBooking appointment. It will create a claims package that includes a copy of the endorsed cashed check if it was indeed cashed.

Currently taxpayers who already have an income tax number do not need to apply for a separate tax identification number as the income tax number is the tax identification number. In step four youll enter the number of the search criteria you selected. To check Income Tax Refund status online enter PAN and select the assessment year.

Calling the IRS at 1-800-829-1040 Wait times to speak to a representative may be long Looking for emails or status updates from your e-filing website or software. Ad Learn How Long It Could Take Your 2021 State Tax Refund. If you have registered before your income tax number will be shown see next step 4.

Enter the PAN acknowledgement number and captcha code. The Income Tax E-filing Portal. These services can be accessed with or without dataairtime.

See if your tax. In step 3 you will need to choose your preferred search criteria BVN NIN or R. Go to e-Daftar and use the given reference number to check your application status.

28 June 2021 Taxpayers can now request specific Personal Income Tax related services by sending an SMS to SARS on 47277. The Department of Revenue has set up a special website for people to check their income tax number and tax identification number. Fill in the Information.

The IRS will determine whether the check was cashed. Viewing your IRS account information. Complete the form and choose Whats My Tax Number as the.

The second step is to pick your birth date. The tax number for individuals will start with 012 or 3. Option 1 Download Online.

How to check your application status. If you are registered on eFiling you can just log on and check your SARS tax number. The two ways to check refund Status are.

Resident alien who is based on days present in. Go to the nearest Finanzamt and ask for it. Click on the Request your Tax number.

Check your Income Tax for the current year. You can ask the IRS to trace it by calling 800-829-1954 or by filling out and sending in Form 3911 the Taxpayer Statement Regarding Refund. The easiest way is to request it from SARS.

The Income Tax Department issues the IT refund once the ITR is processed. Check the number on your previous tax returns correspondence from SARS or tax documents like a retirement annuity medical or pension forms. The agency will ask the person calling to provide identifying information to show they have the authorization to.

Method 1Finding the Federal Tax ID Number of a Third Party. This service is part of the personal tax account and you can use it to check.

How To Check If Your Pan Card Is Active Or Not Credit Card Statement Online Taxes Active

Income Tax Form Ontario 4 Things To Expect When Attending Income Tax Form Ontario Income Tax Filing Taxes Tax Forms

U S Tax Refunds Down Nearly 9 Percent Vs Year Ago Irs Data Irs Tax Forms Tax Return Irs Forms

Fillable Form 1040 Individual Income Tax Return Income Tax Income Tax Return Tax Return

Ohio Income Tax Form 12 12 12 Things Nobody Told You About Ohio Income Tax Form 12 12 Tax Forms Income Tax Tax Refund

5 Income Tax Tips For Notaries And Signing Agents Tax Deductions Irs Taxes Tax Questions

Teevee Today How To Check Income Tax Refund Status Online In 2021 Tax Refund Income Tax Income

New Deadline Check Your Pan Aadhaar Status Here Financial Documents File Income Tax Number Cards

New Mexico Personal Income Tax Spreadsheet Feel Free To Download Income Tax Income Tax

How To Check Income Tax Return Status Online Income Tax Return Income Tax Tax Return

Pin By Robyngaylor On My Gov Tax File Number Net Income Income Tax

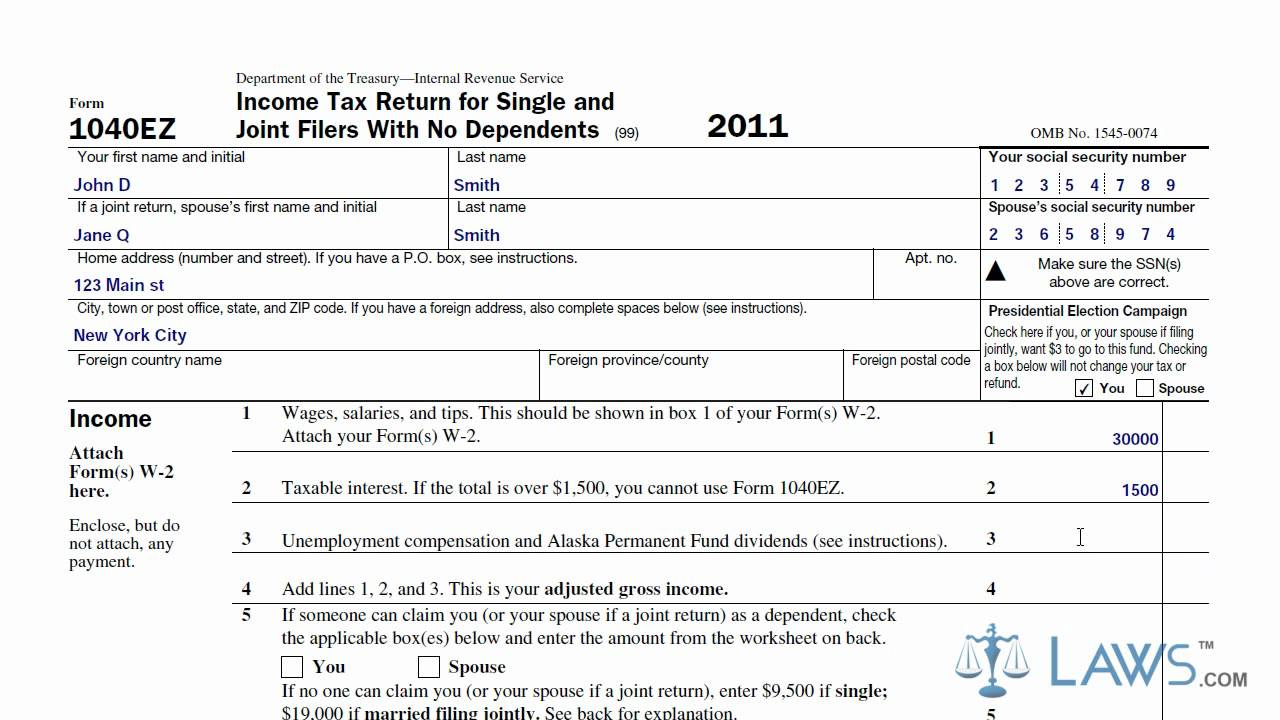

Learn How To Fill The Form 1040ez Income Tax Return For Single And Joint Filers With No Dependents Income Tax Return Income Tax Tax Return

Tax Return Fake Tax Return Income Tax Return Tax

Irs Releases Draft Form 1040 Here S What S New For 2020 Irs Forms Income Tax Return Tax Return

The 1040ez Is The Most Basic Of Tax Return Forms You Will Most Likely Fill One Of These Out After You Get Your First J Tax Refund Tax Return Income Tax

In Most Cases Income Filing Status And Age Determine If A Taxpayer Must File A Tax Return Other Rules Estimated Tax Payments Federal Income Tax Tax Payment

New W 11 Form 11 The Shocking Revelation Of New W 11 Form 11 Federal Income Tax Irs Income Tax

Tax Season Is Over Here S How To Make Next Year S Even Easier How To Get Money Tax Season Income Tax Return

Best Ways To Get The Most Money When You Fill Out Your W 4 Form W4 Tax Form Tax Forms Tax